Product Taxability: Why should I categorize my products in TaxJar?

The product categorization & exemptions feature allows you to tell TaxJar more specific information about your sales that were not taxed.

- Completing this step will allow you to enroll in AutoFile and ensure that your exempt sales are excluded from the return so you won't have to pay tax on those items.

- It will also ensure that your TaxJar "Expected Sales Tax Due" tab is accurate so you can more easily use that tab to troubleshoot sales tax issues.

In this article

- How to Categorize your Products in TaxJar

- Who can use Product Categorization?

- Why don't I see the option to categorize my products?

- How do I know which category to choose for each of my products

- Will I have to categorize my tax-exempt products every time I make a sale?

- Does this feature also handle tax-exempt customers

How to Categorize your Products in TaxJar

1. Click the "Exemptions" tab on your TaxJar dashboard

You'll then see a screen showing all of your products. Products are marked as "uncategorized" when TaxJar shows that you either:

a) did not collect sales tax

b) collected a different amount of sales tax than our tax engine expected

Important to note: Most products in your "Exemptions" tab will be products like groceries, clothing items, medicine, etc. that are not taxed in some states. By telling TaxJar why you didn't collect sales tax on them, your TaxJar Reports will be more accurate, and you'll be able to AutoFile your sales tax returns more accurately.

Alternatively, you'll be guided to the "Exemptions" tab if you attempt to sign up for AutoFile and we see that you have untaxed transactions.

2. From here, just select a product (or multiple products) and choose the right category:

You can also use the search bar to search for a certain product or product type.

Once you have categorized your untaxed or differently-taxed products, your TaxJar state reports will appear more accurate and you can enroll in AutoFile.

This video will walk you through categorizing your products:

Frequently Asked Questions about Product Categorization

1. Who can use Product Categorization?

TaxJar users* who sell on these supported platforms, or who use the TaxJar API (or a combination of supported carts and our API) may be able to classify exempt sales via the Exemptions tab.

2. Why don't I see the option to categorize my products?

You may have connected a combination of unsupported carts to your TaxJar account.

3. How do I know which category to choose for each of my products?

If you are an Amazon seller, you should choose the same category in TaxJar that you chose for your product when setting up your Product Tax Codes on Amazon. If you don't remember which product tax codes you chose, you can see them in your "Inventory Report" in Seller Central.

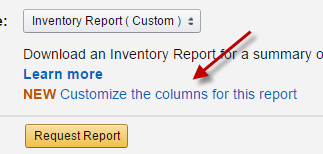

- To pull that report in Seller Central, go to "Inventory" -> "Inventory Report" and then click "Customize the columns for this report."

When customizing your report, make sure to include identifying info such as the SKU or ASIN, and the "product tax codes" field. This will allow you to download a report and see your products and their associated product tax codes.

- Thanks to Karen Holmes and the Karen Brit blog for providing this information. Read more about finding a product tax code report in Amazon here.

- Another CPA, Georgene S. Harkness shares: How to Code Your SKUs for Sales Tax in Amazon and also, How to Change Product Tax Codes.

If you are a Shopify Seller: You should choose the same category in TaxJar that you chose for your product when setting up your Tax Overrides on Shopify. If you don’t remember what overrides you used, you can find out more in the Tax Overrides and Exemptions section of the Shopify Sales Tax Manual.

If you are a TaxJar API user, we will pull this information automatically if you assigned your products an API product categories. (You can see a full list of product categories our API supports here.)

4. Will I have to categorize my tax-exempt products every time I make a sale?

No. If you have previously categorized a product in TaxJar, we will automatically recognize that product every time you sell it again and apply the appropriate category.

If you commonly sell new tax-exempt or differently taxed products, you will need to go into your TaxJar account and categorize them before we AutoFile your sales tax returns. We’ll send you a reminder about this along with your AutoFile confirmation email every filing period.

5. Does this feature also handle tax-exempt customers?

This feature categorizes tax-exempt products. If you need to designate an exempt customer (such as a non-profit or government entity) as tax-exempt here, see how to designate individual wholesale exempt transactions in TaxJar here.

- If you're using the TaxJar API, you can classify your wholesale orders and items sold to tax-exempt organizations via the API.

- You can also designate exempt transactions due to wholesale, resale, or exempt entities via CSV file upload.

- Once you categorize your sales due to customer exemption, our Expected Report and therefore AutoFile will reflect these transactions as sales tax exempt.

6. I already entered my product tax codes into Amazon. Does TaxJar automatically know how my products are categorized?

TaxJar connects with your Amazon account and pulls in your transaction data. Amazon currently doesn’t share your product tax code information.

- At this time, you will need to take this additional step to categorize your products in TaxJar.